How Private Equity Supports Management Teams With Complementary Acquisitions

For ambitious managers, one of the top benefits of partnering with private equity is to get more support for complementary M&A.

Nevertheless, at Volpi Capital, we often come across executives who have blurry ideas about when it might make sense to pursue M&A, how to select target companies and then execute a transaction. In this short post, we will explain: (1) why a company would want to pursue complementary acquisitions, (2) what these transactions look like, and (3) how to execute them.

1. Why should companies pursue complementary acquisitions?

In one word, it is to pursue synergies.

There is a common theory in finance, which continues to be taught in most business schools. The theory goes that if an investor combines a multitude of small businesses (without doing anything else), then the combined group will become more valuable than the individual sum of its parts. A believer of this theory might argue that bigger businesses have more mature leadership teams, stronger brands, and therefore, carry less risk for investors to hold.

At Volpi, we disagree with the notion that scale by itself creates more value. Instead, we believe that acquisitions need to be coupled with complementary synergies and deep organisational integration. Only as a truly integrated business can the combination create more value for its customers, employees, and shareholders alike.

Consequently, across the Volpi Capital portfolio, we actively pursue and encourage complementary acquisitions only when they fit a predetermined strategy. This strategy needs to be clearly articulated, and lead to a joint business plan with the target company, which is in place before executing a transaction. This ensures that all stakeholders have the same objectives with the acquisition, which helps to retail all employees, facilitates the integration, and maximises the chances of success.

When making a joint business plan, we classify these complementary synergies in the following categories:

- Cross-selling customers with a broader portfolio

- Opening new markets with additional go-to-market routes

- Complementing the portfolio with new capabilities

- Increasing the scale of the R&D, marketing, and sales functions

- Accessing preferable terms from partners

The joint business planning stage allows the combined management team to prioritise the synergies and agree on a short-term and long-term timeline.

2. What is complementary M&A?

At a transactional level, there are two types of M&A of acquisitions.

The first is an “asset transaction” where the acquiror purchases IP, real estate or contracts. In this case, the acquisition is less transformational as it tends to not include any employees or personnel. The second and more common model involves share transactions. In this case, an acquiror would purchase 100% of the shares in a target company. The target’s employees, brand, contracts, and liabilities would then all be in the scope of the transaction. These transactions are more ambitious in scope, but potentially much more impactful.

The general rule of thumb is to fund these acquisitions with existing cash and bank debt first, as they are generally the cheapest forms of financing. In addition, in most of our investments, we see significant re-investments from the target company owners, who then join the combined group as senior managers. Lastly, the shareholders of the acquiror can raise more equity, which is obviously not a problem for a private equity fund. Therefore, funding for M&A transactions can come from a combination of four instruments:

- Existing cash on the acquiror’s balance sheet

- Additional bank debt

- Re-investment from target company’s owners, who decide to invest proceeds in the combined holding company

- New equity injection from the acquiror’s owners

3. How do we go about it?

In order to identify the most synergistic acquisition target, the search process usually starts with an internal workshop to align on the selection criteria. The management team takes the driving seat in this phase to define the criteria, constraints, “must haves” and “nice to haves”. The criteria may include the following:

- Geography

- Company size

- Business model (for e.g. services, managed support, software, etc.

- Product capability or service offering

- Technology stack

- Customer base

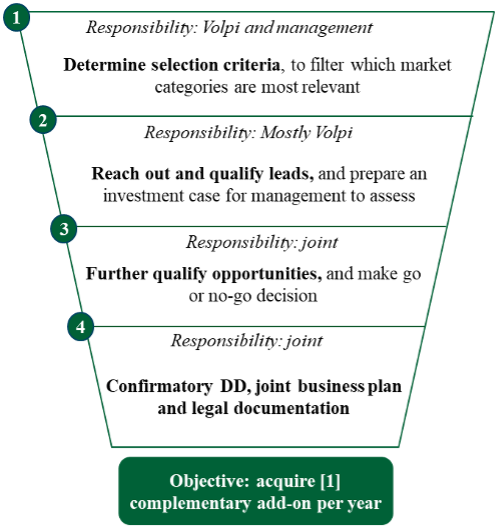

Typical M&A funnel:

Once management has articulated the acquisition criteria, typically the Volpi team will source relevant opportunities via direct outreach, our existing network, M&A advisers, or industry conferences. Qualified opportunities will be discussed at the board level, and management will give their “go” or “no-go” decision.

In the event of a positive recommendation, Volpi will lead mostly the due diligence and documentation workstreams, while management will focus on the joint strategy and business plan.

Once the acquisition is complete, it is time to execute the join plan, but that is for another post!

We'd love to hear from you

To discuss how Volpi can support your company’s M&A strategy, please contact us below.