What’s Driving Change in the Microsoft Partner Landscape?

Posted on 7th November 2024

From Value Add Resellers (VARs) to System Integrators (SIs), ISVs (Independent Software Vendors) and MSPs (Managed Service Providers), there are more than 400,000 partners worldwide developing, marketing, and delivering Microsoft solutions. At Volpi Capital, we see significant value creation opportunities for partners in this ecosystem.

All boats rise with the tide

A growing suite of pre-integrated solutions in low-code, analytics, cloud infrastructure, productivity and business applications, and cybersecurity / DevOps tools positions Microsoft as a winning platform that creates a powerful "snowball effect" for partners and clients alike. A compelling solution offering, coupled with a symbiotic & thriving partner ecosystem where 95% of Microsoft's commercial revenue is tied to partners ; creates ample room for growth among both established players and innovative newcomers filling niche gaps in the market.

Partner business model transitions

Traditional resale of licenses – once a volume-driven, transactional activity with limited value-add - has transitioned to managed cloud consumption services. Partners now focus on optimizing clients’ usage of cloud resources, providing value through continuous optimization, monitoring, and proactive adjustments within their Azure environments. They also have increased ability to use the Microsoft platform “lego blocks” to develop their own IP, and distribute it globally via its B2B app store.

Similarly, instead of basic deployments or lift & shift migrations, partners are now targeting specialized consulting and complex integrations in fast-growing solution areas like advanced analytics, cybersecurity, & GenAI (where we’re seeing growth rates as high as 86% YoY ).

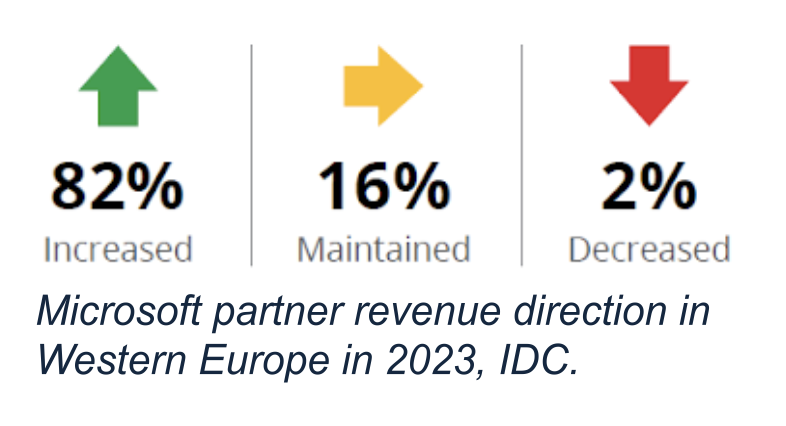

In a September 2024 report by Microsoft, it is estimated that that 62% of total partner revenue now comes from services and that partners generate on average $8.45 to $10.93 for every $1 of Microsoft revenue.

It pays to be focused on Microsoft and their full solution portfolio

Microsoft naturally favours partners who can deliver comprehensive, end-to-end solutions, driving greater adoption and usage of Microsoft’s products. In turn, these partners benefit from access to more attractive resale margins & partner incentives, co-marketing and co-sell programs, partner specialization training, early access to upcoming releases & features, awards, and even R&D investments.

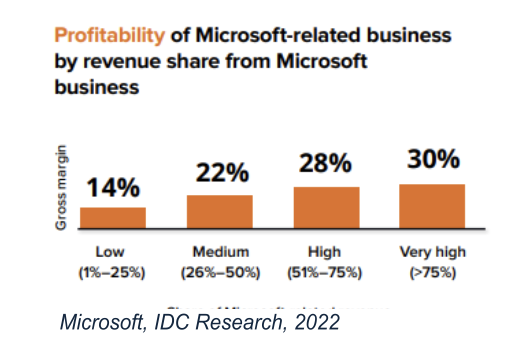

Data shows that partners deriving at least 75 percent of their revenue from their Microsoft-related activities have the highest profitability, with an average gross margin of 30%, compared to just 14% for those with minimal Microsoft alignment (1-25% revenue)3.

Furthermore, partners who engage across 5 or more solution areas, leveraging opportunities for upsell, cross-sell, and expanded wallet share, achieve nearly double the growth rate of those specializing in a single solution area4.

Industry-specific solutions & partner IP are driving significant revenue

The highest economic value for Microsoft partners is derived from proprietary IP. While productized software solutions are certainly a big part of this, a significant portion of high-margin IP extends beyond software. Often overlooked, “soft IP” is the deep expertise in configuring Microsoft technologies, establishing workflows, and implementing best practices for specific industries. For many partners, the real differentiation and tangible value to customers lies in their nuanced understanding of sector-specific needs, like configuring cloud environments for regulatory compliance in financial services, optimizing ERP setups for manufacturing or implementing secure data governance frameworks in healthcare.

Strategic consolidation as a growth strategy

The Microsoft partner market’s fragmentation, with an eclectic mix of established partners and emerging niche players mostly in local geographies, creates a unique opportunity for international PE-backed strategic consolidation; a trend we expect to continue.

By bringing together specialists across various solution areas and markets, consolidated entities can address capability gaps and expand their market reach, becoming “super partners” with the scale, resources, and deep multifaceted expertise needed to deliver tangible value to customers in complex Microsoft solutions use cases. These sector-leading super partners can, in turn, activate all the growth levers discussed here —driving growth through differentiated offerings and proprietary IP, unlocking higher-margin services, upsell and cross-sell opportunities, and fully capitalizing on their symbiotic relationship with Microsoft.

If you’re a partner looking to accelerate growth, or simply wish to discuss the future of the ecosystem with us, we’d be delighted to have a chat. Please get in touch with Justin Franssen (justin@volpicapital.com), Marc Andreoli (marc@volpicapital.com) and/or Tom Mears-Alcaide (tom@volpicapital.com). Thank you!

1 IDC, 2022

2 Microsoft Partners: Driving Economic Value & AI Maturity. Microsoft, IDC

3 Microsoft, IDC Research, 2022.

4 Microsoft Partner Economic Value Indicator Survey